Bitcoin Price Prediction for This Year sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

In the wild world of Bitcoin, predicting its price for the year ahead is like trying to catch a wave – exhilarating, unpredictable, and full of surprises. From market influences to expert opinions and technical analysis, this overview will dive into the factors shaping Bitcoin’s future value.

Factors Influencing Bitcoin Price Prediction: Bitcoin Price Prediction For This Year

Bitcoin price predictions are influenced by various factors that can impact the market dynamics and investor sentiment. Understanding these key factors is crucial for making informed forecasts.

Market Demand and Supply

- The interaction between market demand and supply plays a significant role in determining the price of Bitcoin.

- Increased demand for Bitcoin, driven by factors such as institutional adoption or macroeconomic uncertainty, can lead to price appreciation.

- Conversely, an oversupply of Bitcoin in the market may put downward pressure on prices.

Regulatory Developments

- Regulatory developments, such as government policies on cryptocurrency usage and exchanges, can have a major impact on Bitcoin price predictions.

- Positive regulatory news, like the approval of Bitcoin ETFs or friendly regulations, can boost investor confidence and drive prices higher.

- Conversely, negative regulatory actions, like bans or restrictions, can lead to price volatility and uncertainty in the market.

Institutional Investments

- The entry of institutional investors into the Bitcoin market has been a key driver of price predictions.

- Institutional players, such as hedge funds, corporations, and asset managers, can bring significant capital into Bitcoin, influencing its price trajectory.

- Increased institutional interest is often seen as a bullish signal for Bitcoin, as it suggests growing mainstream acceptance and adoption.

Historical Trends in Bitcoin Price Predictions

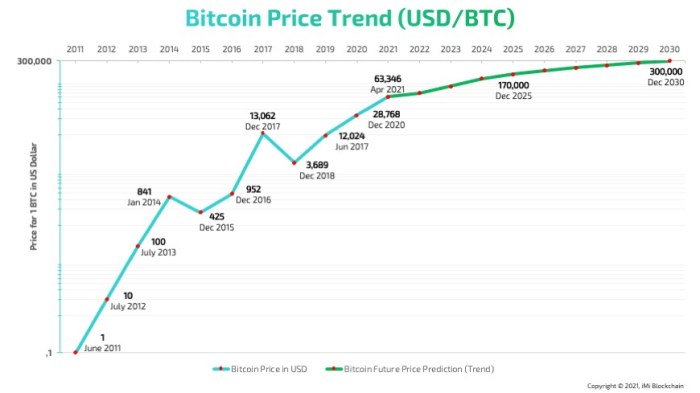

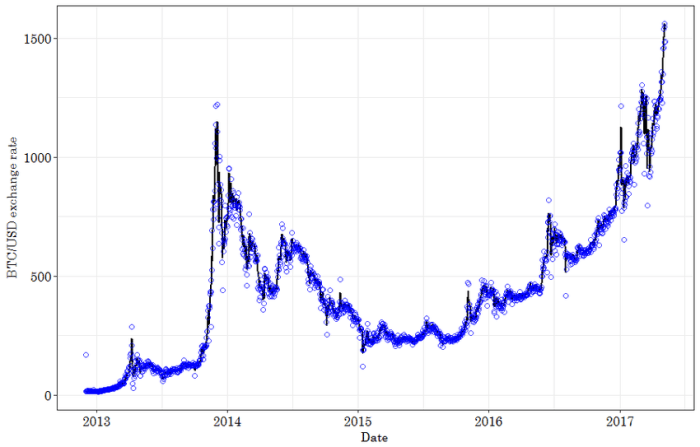

Bitcoin’s price history is marked by significant volatility, with extreme highs and lows over the years. Analysts and experts have attempted to predict these price movements based on various factors, including market trends, technological developments, regulatory news, and economic events.

Bitcoin Price Movements Overview

Bitcoin’s price started at a few cents when it was first introduced in 2009 and experienced a significant spike in 2017 when it reached an all-time high of nearly $20,000. However, it also witnessed sharp declines, with price corrections and bear markets following the bull runs.

Patterns in Bitcoin Price Predictions, Bitcoin Price Prediction for This Year

Analysts have observed patterns in Bitcoin price predictions, such as recurring cycles of boom and bust. Some experts use technical analysis, chart patterns, and historical data to forecast future price movements. However, the cryptocurrency market’s inherent volatility makes accurate predictions challenging.

Influential External Events

External events, such as regulatory decisions, market sentiment, macroeconomic factors, and global events, have influenced Bitcoin price forecasts in the past. For example, news of regulatory crackdowns or institutional adoption can lead to significant price fluctuations.

Comparison of Predictions and Outcomes

While some Bitcoin price predictions have been remarkably accurate, many have also missed the mark. Factors like unexpected market movements, external events, and changes in investor sentiment can lead to deviations from forecasted price levels. It is essential to consider a wide range of factors when making Bitcoin price predictions to account for uncertainties in the market.

Expert Opinions on Bitcoin Price Forecast

Cryptocurrency experts play a crucial role in predicting Bitcoin prices based on various methodologies and analysis. Their insights often guide investors and traders in making informed decisions in the volatile market. Let’s delve into some key aspects of expert opinions on Bitcoin price forecasts.

Methodologies Used by Experts

- Technical Analysis: Experts analyze historical price data, trading volume, and market trends to identify patterns and predict future price movements.

- Fundamental Analysis: This approach involves assessing factors such as adoption rates, regulatory developments, and macroeconomic indicators to determine Bitcoin’s intrinsic value.

- Sentiment Analysis: Experts gauge market sentiment through social media, news sentiment, and other sources to predict shifts in investor behavior and price movements.

Accuracy of Expert Opinions

- While some experts have accurately predicted major price movements in Bitcoin, others have failed to foresee sudden market shifts.

- The unpredictability of the cryptocurrency market makes it challenging for experts to provide consistent and precise forecasts.

- Investors should consider a range of expert opinions and conduct their research to make well-informed decisions.

Diverse Expert Perspectives

- Some experts believe that Bitcoin’s price will continue to rise due to increasing institutional adoption and limited supply.

- Others are more cautious, citing regulatory uncertainties and market manipulation as potential risks to Bitcoin’s price stability.

- There are also experts who predict a period of consolidation or a price correction in the near future based on market indicators.

Technical Analysis for Bitcoin Price Prediction

When it comes to predicting Bitcoin prices, technical analysis plays a crucial role in providing insights into potential price movements based on historical data and market trends.

Technical Indicators for Bitcoin Price Predictions

- Relative Strength Index (RSI): Measures the speed and change of price movements to determine overbought or oversold conditions.

- Bollinger Bands: Shows the volatility and potential price breakouts by measuring standard deviations from a moving average.

- Moving Average Convergence Divergence (MACD): Helps identify trend reversals or momentum shifts by analyzing the relationship between two moving averages.

Chart Patterns in Forecasting Bitcoin Prices

- Head and Shoulders: Indicates a potential trend reversal from bullish to bearish or vice versa.

- Cup and Handle: Suggests a bullish continuation pattern after a consolidation phase.

- Double Top/Bottom: Signals a reversal in the current trend based on price action at key levels.

Trading Volumes in Technical Analysis for Bitcoin

- High trading volumes often accompany price breakouts or breakdowns, confirming the strength of a trend.

- Low trading volumes during a price move may indicate a lack of conviction among market participants.

Role of Moving Averages in Predicting Bitcoin Price Movements

- Simple Moving Average (SMA) and Exponential Moving Average (EMA) are commonly used to identify trend direction and potential support/resistance levels.

- Golden Cross (bullish) and Death Cross (bearish) crossovers between moving averages can signal significant price movements.