Evaluating Crypto as an Investment Option takes you on a journey through the world of digital currency investments, exploring the risks, rewards, and strategies that can lead to financial success. Brace yourself for a wild ride filled with market insights and valuable tips.

Cryptocurrency has taken the financial world by storm, offering a unique investment opportunity that challenges traditional norms. As you delve into this topic, prepare to discover the exciting possibilities and potential pitfalls of investing in crypto assets.

Understanding Cryptocurrency Investments

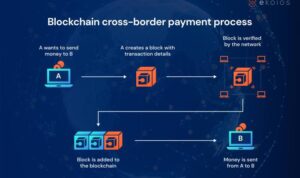

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, making it difficult to counterfeit. Unlike traditional investments like stocks or bonds, cryptocurrencies are decentralized and operate independently of a central authority, such as a government or financial institution.

Key Reasons for Considering Crypto as an Investment Option

- High Potential Returns: Cryptocurrencies have shown the potential for high returns in a short period, attracting many investors looking to capitalize on the market volatility.

- Diversification: Investing in cryptocurrencies can help diversify an investment portfolio, reducing overall risk by not being solely dependent on traditional assets.

- Accessibility: Cryptocurrency investments are accessible to anyone with an internet connection, allowing for global participation without the need for a traditional bank account.

Potential Risks Associated with Investing in Cryptocurrencies, Evaluating Crypto as an Investment Option

- Volatility: The cryptocurrency market is highly volatile, with prices fluctuating rapidly, leading to potential significant gains or losses in a short period.

- Regulatory Risks: Regulatory changes or government interventions can impact the value and legality of cryptocurrencies, posing a risk to investors.

- Security Concerns: Cryptocurrencies are susceptible to hacking and cyber attacks, leading to potential loss of funds if proper security measures are not in place.

Evaluating Factors for Crypto Investments

When considering investing in cryptocurrency, it is crucial to evaluate various factors that can impact the value and potential returns of your investment. These factors can range from technical aspects of the cryptocurrency itself to external market conditions and regulatory developments.

Factors to Consider when Evaluating a Cryptocurrency

- Technology and Innovation: Assess the technology behind the cryptocurrency, including its scalability, security features, and potential for adoption.

- Market Demand: Consider the current and future demand for the cryptocurrency, as well as its use cases and utility in real-world scenarios.

- Team and Development: Evaluate the team behind the cryptocurrency project, their experience, and track record in the industry.

- Community Support: Look into the level of community engagement and support for the cryptocurrency, as a strong community can contribute to its success.

Role of Market Trends and Volatility

Market trends and volatility play a significant role in making investment decisions in the crypto space. It is essential to monitor market trends, such as price movements, trading volumes, and overall sentiment among investors. Volatility can present both opportunities and risks, as prices can fluctuate rapidly in the crypto market.

Impact of Regulatory Developments

Regulatory developments have a direct impact on the value and perception of cryptocurrencies. Changes in regulations can affect the legality of using or trading certain cryptocurrencies, leading to price fluctuations and changes in market dynamics. It is crucial to stay informed about regulatory updates and their potential implications on your crypto investments.

Investment Strategies in Cryptocurrency

Cryptocurrency investment strategies can vary greatly, depending on the goals and risk tolerance of individual investors. Here, we will explore different approaches that investors can use in the crypto market.

Long-Term Investment vs Short-Term Trading

When it comes to investing in cryptocurrency, investors can choose between long-term investment strategies or short-term trading approaches. Long-term investment involves holding onto assets for an extended period, usually years, with the expectation of significant growth over time. On the other hand, short-term trading focuses on buying and selling assets quickly to take advantage of short-term market fluctuations.

Diversification in a Cryptocurrency Investment Portfolio

Diversification is a crucial concept in building a cryptocurrency investment portfolio. By spreading investments across different cryptocurrencies, industries, and asset types, investors can reduce risk exposure and protect against potential losses. Diversifying a portfolio can help balance out volatility and increase the chances of overall profitability.

Tools and Resources for Evaluating Crypto Investments: Evaluating Crypto As An Investment Option

Cryptocurrency investments can be complex, and having the right tools and resources at your disposal is crucial for making informed decisions. Here are some essential resources for evaluating crypto investments:

Cryptocurrency Exchanges

- Popular exchanges like Binance, Coinbase, and Kraken provide real-time data on cryptocurrency prices, trading volumes, and market trends.

- Exchanges also offer advanced charting tools that allow investors to perform technical analysis on various cryptocurrencies.

- By monitoring price movements and trading volumes on exchanges, investors can make more informed decisions about when to buy or sell cryptocurrencies.

CoinMarketCap and CoinGecko

- Websites like CoinMarketCap and CoinGecko aggregate data from multiple exchanges to provide comprehensive information on thousands of cryptocurrencies.

- Investors can use these platforms to track price movements, market capitalization, trading volume, and historical data for different cryptocurrencies.

- Comparing the performance of various cryptocurrencies can help investors identify potential investment opportunities.

Technical Analysis Tools

- Technical analysis involves studying historical price charts and using mathematical indicators to predict future price movements.

- Tools like TradingView and CryptoCompare offer a wide range of technical analysis tools, including moving averages, RSI, and MACD.

- Investors can use these tools to identify trends, support and resistance levels, and potential entry and exit points for their trades.

News Outlets and Social Media

- Staying updated on news and developments in the crypto market is essential for making informed investment decisions.

- Platforms like CoinDesk, Cointelegraph, and Twitter can provide real-time updates on market trends, regulatory changes, and new cryptocurrency projects.

- By following reputable news sources and influencers in the crypto space, investors can stay ahead of market movements and potential opportunities.