Kicking off with How Blockchain is Changing the Financial Industry, this opening paragraph is designed to captivate and engage the readers, setting the tone american high school hip style that unfolds with each word.

Blockchain technology is revolutionizing the financial industry, bringing about significant changes in how transactions are conducted and secured. From enhancing security to enabling smart contracts, the impact of blockchain is reshaping the financial landscape. Let’s dive into the world of blockchain and explore its transformative effects on finance.

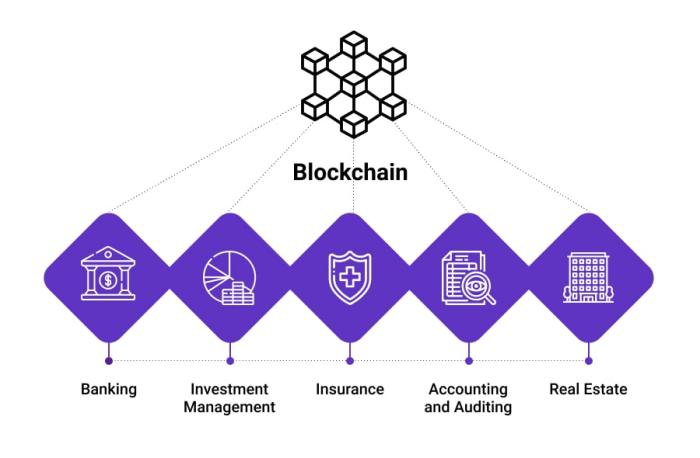

Overview of Blockchain Technology in Finance

Blockchain technology is a decentralized, distributed ledger system that securely records transactions across multiple computers. Each transaction is stored in a block that is linked to the previous block, forming a chain of blocks, hence the name blockchain. This technology ensures transparency, security, and immutability of data, making it ideal for financial transactions.

Examples of Blockchain in Financial Industry

- Payment Processing: Blockchain can facilitate fast and secure cross-border payments, reducing transaction costs and processing times.

- Smart Contracts: Automated contracts can be executed on a blockchain, eliminating the need for intermediaries and reducing the risk of fraud.

- Trade Finance: Blockchain can streamline trade finance processes by providing a transparent and secure platform for documentation and verification.

Benefits of Using Blockchain in Financial Transactions

- Transparency: All transactions on the blockchain are visible to participants, reducing the risk of fraud and ensuring accountability.

- Security: The decentralized nature of blockchain makes it resistant to hacking or tampering, ensuring the integrity of financial data.

- Efficiency: Blockchain can automate and streamline processes, reducing the time and cost associated with traditional financial transactions.

Impact of Blockchain on Security and Transparency

Blockchain technology has revolutionized the financial industry by significantly enhancing security and transparency in transactions. The decentralized nature of blockchain makes it nearly impossible for malicious actors to tamper with data, ensuring the integrity of financial records and transactions.

Enhanced Security

- Blockchain utilizes cryptographic techniques to secure data, making it extremely difficult for hackers to alter information.

- Each transaction is encrypted and linked to the previous one, creating a chain of blocks that is resistant to manipulation.

- Consensus mechanisms such as Proof of Work or Proof of Stake ensure that transactions are verified by multiple participants, further bolstering security.

Improved Transparency, How Blockchain is Changing the Financial Industry

- Blockchain provides a transparent and immutable ledger of transactions that can be accessed by all participants in the network.

- Every transaction is recorded in a chronological order, allowing for complete traceability of funds and assets.

- Smart contracts, which are self-executing contracts with predefined rules, ensure that transactions are transparent and automated.

Smart Contracts and Automation in Finance

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller directly written into lines of code. These contracts automatically execute actions when certain conditions are met, eliminating the need for intermediaries in financial transactions.

Examples of Automated Processes in Finance Enabled by Blockchain

- Loan Disbursements: Smart contracts can automate the process of verifying loan eligibility and disbursing funds once all conditions are met.

- Trade Settlements: Blockchain can automate the settlement process for trades, reducing the time and cost involved in traditional methods.

- Insurance Claims: Claims processing in insurance can be automated through smart contracts, ensuring quick and transparent payouts.

Advantages of Using Smart Contracts for Financial Transactions

- Efficiency: Smart contracts automate processes, reducing the need for manual intervention and speeding up transactions.

- Transparency: All parties involved in a smart contract can view the terms and conditions, ensuring trust and transparency in the transaction.

- Security: Blockchain’s immutable nature ensures that once a smart contract is executed, it cannot be altered, providing a secure environment for financial transactions.

Regulatory Challenges and Adoption of Blockchain: How Blockchain Is Changing The Financial Industry

Blockchain technology has been disrupting the financial industry, offering increased security, transparency, and efficiency. However, the adoption of blockchain also comes with regulatory challenges that financial institutions need to navigate.

Regulatory Challenges Faced by the Financial Industry

- Uncertainty in regulatory frameworks: Governments and regulatory bodies are still in the process of defining clear regulations for blockchain technology in finance, leading to uncertainty for financial institutions.

- Compliance with anti-money laundering (AML) and know your customer (KYC) regulations: Ensuring compliance with AML and KYC regulations while using blockchain technology can be challenging due to the pseudonymous nature of blockchain transactions.

- Data privacy concerns: Blockchain’s immutable and transparent nature raises concerns about data privacy and the protection of sensitive financial information.

Government Responses to Blockchain Integration

- Regulatory sandboxes: Some governments have created regulatory sandboxes to allow financial institutions to test blockchain solutions within a controlled environment before full implementation.

- Collaboration with industry stakeholders: Governments are collaborating with industry stakeholders to develop regulatory frameworks that balance innovation with consumer protection.

- Educational initiatives: Governments are investing in educational initiatives to increase awareness and understanding of blockchain technology among regulators and policymakers.

Comparison of Adoption Rates Across Financial Institutions

- Large banks: Traditional financial institutions, such as large banks, have been slower to adopt blockchain technology due to regulatory concerns, legacy systems, and the need for significant infrastructure changes.

- Fintech companies: Fintech companies have been more agile in adopting blockchain technology, leveraging its benefits to offer innovative financial services and products.

- Central banks: Some central banks are exploring the use of blockchain technology for issuing digital currencies, with varying degrees of progress and adoption.

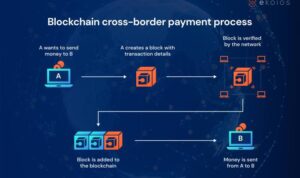

Blockchain in Cross-border Transactions

Blockchain technology is revolutionizing cross-border transactions in the financial sector by providing a secure and transparent way to transfer funds across borders. One of the key impacts of blockchain in this area is the significant reduction in transaction costs associated with international payments. This has the potential to make cross-border transactions more efficient and cost-effective for businesses and individuals alike.

Role of Cryptocurrencies in Cross-border Transactions

- Cryptocurrencies, such as Bitcoin and Ethereum, play a crucial role in facilitating cross-border transactions by providing a decentralized and borderless form of digital currency.

- These digital assets can be transferred across borders quickly and securely, without the need for traditional banking intermediaries, reducing transaction times and costs.

- Smart contracts powered by blockchain technology enable automatic execution of transactions once predefined conditions are met, further streamlining the cross-border payment process.