How Crypto is Making Payments Faster and Cheaper sets the stage for a cutting-edge discussion on the evolution of payment systems, drawing readers into a world where speed and efficiency reign supreme.

Let’s delve into the realm of cryptocurrencies and explore how they are reshaping the way we handle transactions in today’s digital age.

Understanding Crypto Payments

Cryptocurrency is a digital form of currency that uses cryptography for security. It differs from traditional payment methods like cash or credit cards because it operates independently of a central authority, such as a bank. Transactions are recorded on a decentralized ledger called a blockchain.

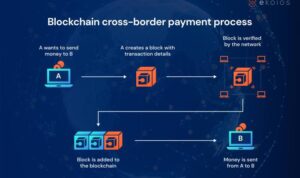

Technology Behind Crypto Payments

- Crypto payments are processed through blockchain technology, which ensures secure and transparent transactions.

- Each transaction is verified by network nodes and then added to the blockchain as a block.

- Miners use powerful computers to solve complex mathematical puzzles to validate transactions and add them to the blockchain.

Popular Cryptocurrencies

- Bitcoin: the first and most well-known cryptocurrency, often used for online purchases and investments.

- Ethereum: known for its smart contract functionality and used for a variety of decentralized applications.

- Ripple: designed for quick and low-cost international money transfers, often used by banks and financial institutions.

Benefits of Crypto Payments

Cryptocurrency payments offer several advantages over traditional banking systems, including speed, cost-effectiveness, and efficiency.

Faster Transactions

One of the key benefits of using cryptocurrencies for payments is the speed at which transactions can be processed. Traditional banking systems often involve lengthy processing times due to various intermediaries and verification processes. In contrast, crypto payments can be completed in a matter of minutes, regardless of the time or day.

Cost-Effectiveness

Another significant advantage of crypto payments is their cost-effectiveness. Traditional banking transactions can incur high fees, especially for cross-border payments or large transactions. With cryptocurrencies, transaction fees are typically lower, making them a more affordable option for individuals and businesses.

Revolutionizing Cross-Border Transactions

Crypto payments have revolutionized the way cross-border transactions are conducted. Previously, international payments could take days to process and involve multiple fees and exchange rate fluctuations. With cryptocurrencies, cross-border payments can be completed almost instantly, with lower fees and without the need for currency conversions.

Security in Crypto Payments

Cryptocurrency transactions are protected by various security measures to ensure the safety of funds and personal information. One of the key features of crypto payments is the use of blockchain technology, which provides a decentralized and secure way to record transactions.

Comparison to Traditional Banking Security

- Crypto payments rely on encryption techniques to secure transactions, making it extremely difficult for hackers to intercept or alter payment information.

- Traditional banking systems are centralized, making them more susceptible to cyber attacks and data breaches.

- With crypto payments, users have control over their private keys, adding an extra layer of security compared to traditional banking where the bank holds all the information.

Incidents of Compromised Crypto Payments, How Crypto is Making Payments Faster and Cheaper

- In 2014, Mt. Gox, one of the largest cryptocurrency exchanges at the time, was hacked, resulting in the loss of over 850,000 bitcoins. This incident highlighted the importance of security measures in the crypto space.

- In 2019, Binance, a major cryptocurrency exchange, experienced a security breach where hackers stole 7,000 bitcoins. However, Binance was able to cover the losses through its Secure Asset Fund for Users (SAFU) fund.

- Despite these incidents, many advancements have been made in crypto security, with exchanges implementing stricter security protocols and users becoming more aware of best practices to safeguard their funds.

Adoption of Crypto Payments: How Crypto Is Making Payments Faster And Cheaper

Cryptocurrency payments have been gaining traction in recent years, with more businesses across various industries starting to accept digital currencies as a form of payment. This shift is not only driven by the desire to cater to tech-savvy consumers but also by the benefits that crypto payments offer, such as lower transaction fees and faster processing times.

Current Trends in Businesses Accepting Crypto Payments

- Major retailers like Overstock, Microsoft, and Shopify have started accepting cryptocurrencies as payment for goods and services.

- Online platforms such as Etsy and Twitch also allow users to make purchases using digital currencies.

- Some restaurants, coffee shops, and even real estate agencies have begun to embrace crypto payments to attract a new customer base.

Consumers Using Cryptocurrencies for Everyday Transactions

- More consumers are using cryptocurrencies for everyday transactions like grocery shopping, paying bills, and even booking travel accommodations.

- Mobile apps and digital wallets make it easier for individuals to store and spend their digital assets seamlessly.

- The convenience and security of crypto payments are appealing to a growing number of tech-savvy consumers.

Future of Crypto Payments and Mainstream Adoption

- Experts predict that the adoption of crypto payments will continue to grow as more businesses and consumers recognize the benefits of digital currencies.

- Regulatory developments and advancements in blockchain technology are expected to make crypto payments more secure and efficient in the future.

- Mainstream financial institutions are also exploring ways to integrate cryptocurrencies into their existing payment systems, further driving the acceptance and adoption of digital assets.