How to Analyze Crypto Market Trends dives deep into the world of cryptocurrency, unraveling the mysteries behind market movements and trends. With a focus on fundamental and technical analysis, this guide is your roadmap to navigating the volatile crypto landscape.

Explore the tools, strategies, and insights needed to stay ahead in this ever-evolving market. Let’s embark on this thrilling journey together!

Fundamental Analysis of Crypto Market Trends

Understanding fundamental analysis is crucial when analyzing crypto market trends as it helps investors make informed decisions based on the underlying value of a cryptocurrency rather than just market sentiment or price movements.

Key Factors in Fundamental Analysis for Cryptocurrencies

- Market Cap: The total value of a cryptocurrency in circulation, indicating its size and potential for growth.

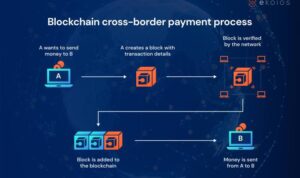

- Technology: Assessing the blockchain technology, scalability, security features, and development team behind the cryptocurrency.

- Use Case: Understanding the practical applications and real-world utility of the cryptocurrency.

- Community and Adoption: Examining the level of community support and mainstream adoption of the cryptocurrency.

Impact of News, Regulations, and Technology Advancements

- News: Positive or negative news can significantly influence market sentiment and price movements of cryptocurrencies.

- Regulations: Changes in regulations by governments or regulatory bodies can impact the legality and acceptance of cryptocurrencies.

- Technology Advancements: Innovations and upgrades in blockchain technology can enhance the functionality and value proposition of cryptocurrencies.

Technical Analysis Tools for Analyzing Crypto Market Trends: How To Analyze Crypto Market Trends

Cryptocurrency market trends can be analyzed using various technical analysis tools that help traders make informed decisions. These tools provide insights into price movements, trends, and potential entry or exit points in the market.

Commonly Used Technical Analysis Tools, How to Analyze Crypto Market Trends

- Moving Averages: Moving averages smooth out price data to identify trends over a specific period. Traders often use the crossover of different moving averages to signal potential buy or sell opportunities.

- Relative Strength Index (RSI): RSI indicates whether a cryptocurrency is overbought or oversold. It helps traders assess the momentum of price movements and potential reversal points.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages. Traders use MACD to identify bullish or bearish signals in the market.

Chart Patterns and Their Significance

- Head and Shoulders: This pattern indicates a potential trend reversal from bullish to bearish or vice versa.

- Double Top/Bottom: Double top signals a bearish reversal, while double bottom signals a bullish reversal.

- Flags and Pennants: These patterns represent short-term continuation patterns, often seen after a sharp price movement.

Role of Volume and Volatility

- Volume: High trading volume often confirms the validity of a price trend, while low volume may indicate a lack of interest or a potential trend reversal.

- Volatility: Volatility measures the degree of price fluctuations in the market. Traders use volatility to assess the risk and potential profitability of a cryptocurrency.

Sentiment Analysis in Crypto Market Trends

Sentiment analysis plays a crucial role in understanding the overall market sentiment towards cryptocurrencies. By analyzing social media, forums, and other online platforms, investors can gauge the emotions and opinions of the market participants, which can influence the price movements of cryptocurrencies.

Tools for Sentiment Analysis in Crypto Market Trends

- Sentiment analysis tools like Twitter Sentiment and Reddit Sentiment are commonly used to track the sentiment of the cryptocurrency market in real-time.

- Platforms such as TheTIE and SentimenTrader provide sentiment analysis reports and data to help investors make informed decisions.

Impact of Social Media and Forums on Sentiment Analysis

Social media platforms like Twitter, Reddit, and Telegram, along with online forums such as Bitcointalk and Reddit, have a significant impact on sentiment analysis of cryptocurrencies. The discussions, news, and opinions shared on these platforms can influence the overall sentiment of the market, leading to fluctuations in cryptocurrency prices.

Market Capitalization and Trends

Market capitalization is the total value of a cryptocurrency in circulation, calculated by multiplying the current price by the total number of coins. It is a crucial metric in analyzing crypto market trends as it provides insights into the overall size and health of a particular cryptocurrency.

Comparison of Market Capitalization

- Bitcoin: As the first and largest cryptocurrency, Bitcoin often sets the tone for the entire market. Its market capitalization is usually the highest among all cryptocurrencies.

- Ethereum: Ethereum is known for its smart contract capabilities and has the second-highest market capitalization in the crypto space.

- Altcoins: Other cryptocurrencies, known as altcoins, have varying market capitalizations based on their popularity, utility, and market demand.

Influence of Market Capitalization on Trends

Market capitalization can significantly impact crypto trends. A rise in market capitalization indicates increased demand and investor confidence, potentially leading to a bullish trend. Conversely, a decrease in market capitalization may signal waning interest and a bearish trend in the market.

Historical Data Analysis for Crypto Market Trends

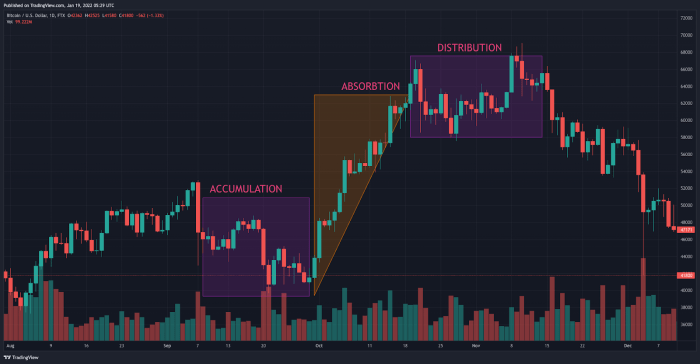

Historical data analysis plays a crucial role in understanding the past trends of cryptocurrencies. By examining historical price movements and market behavior, analysts can gain insights into how different factors have influenced the market in the past.

Significance of Historical Data Analysis

Historical data analysis helps identify patterns and trends that have occurred in the crypto market over time. It allows analysts to track the performance of specific cryptocurrencies, understand market cycles, and assess the impact of external events on price movements.

- Historical price data can be accessed through cryptocurrency exchanges, financial data platforms like CoinMarketCap, CoinGecko, and TradingView.

- Charting tools such as TradingView, Coinigy, and CryptoCompare provide historical price data and advanced charting capabilities for analyzing trends.

- APIs from exchanges like Binance, Coinbase, and Kraken also offer historical data for developers and traders to conduct in-depth analysis.

Predicting Future Trends with Historical Data Analysis

By studying historical data, analysts can identify recurring patterns and behaviors that may indicate potential future trends in the crypto market. Factors such as price cycles, trading volumes, and market sentiment can be analyzed to make informed predictions about future price movements.

Historical data analysis can help traders and investors make better decisions by providing valuable insights into market dynamics and potential opportunities for profit.