Investing in Crypto During Market Volatility sets the stage for some major ups and downs in the crypto world. Get ready to ride the wave of uncertainty with some cool strategies and insights that will have you feeling like you’re back in high school, navigating the halls of crypto chaos.

From understanding market swings to reaping the benefits and facing the risks head-on, this guide will have you ready to rock the crypto scene like a true hipster investor.

Understanding Market Volatility

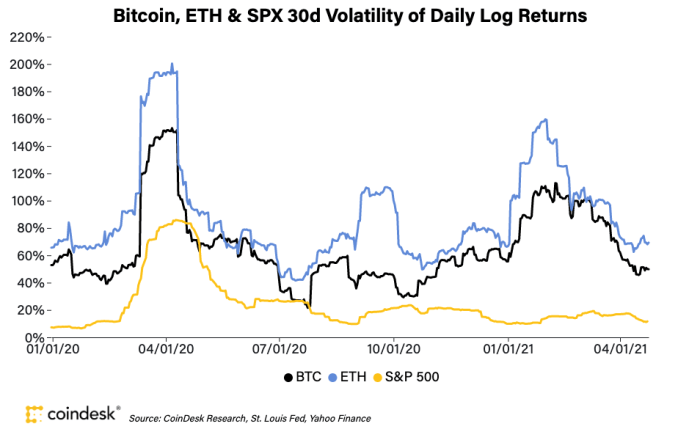

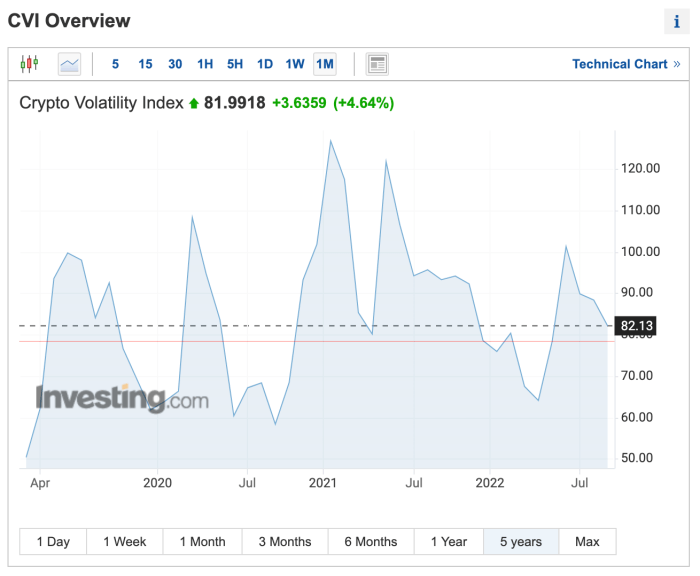

Market volatility in the world of cryptocurrency is like when your favorite rapper drops a surprise album out of nowhere – it’s unpredictable and can make your head spin. It refers to the rapid and significant changes in the price of digital assets within a short period of time. This can be caused by various factors such as market sentiment, regulatory developments, or even a tweet from a high-profile figure.

Impact of Market Volatility on Crypto Investments

When the market is as volatile as a hip-hop feud, it can have a drastic impact on your crypto investments. Prices can skyrocket one minute and crash the next, leaving investors feeling like they’re on a rollercoaster ride. This can lead to quick gains for some, but also significant losses for others who aren’t prepared for the wild swings.

- Example 1: Elon Musk’s Tweets – When Elon Musk tweets about Bitcoin or Dogecoin, the market can go crazy. His tweets have caused prices to surge and plummet, showing just how much influence one person can have on the market.

- Example 2: China’s Crypto Crackdown – Recently, China announced a crackdown on cryptocurrency mining and trading activities. This led to a massive drop in prices across the board, as investors feared the impact of such a major market player taking such a stance.

Benefits of Investing in Crypto During Market Volatility

Investing in crypto during market volatility can present unique opportunities for investors looking to capitalize on price fluctuations and potentially earn high returns. While the crypto market is known for its volatility, this very characteristic can be advantageous for those willing to take calculated risks.

Buying the Dip

When the market experiences a dip or a sudden drop in prices, some investors see this as an opportunity to buy assets at a discounted price. This strategy, known as “buying the dip,” allows investors to acquire more crypto for less money, positioning them for potential profits when prices eventually rise again.

- Buying the dip requires a long-term perspective and confidence in the underlying value of the crypto assets being purchased.

- Successful investors who have mastered the art of buying the dip have been able to accumulate significant wealth by capitalizing on market downturns.

- Timing is crucial when implementing this strategy, as buying too early or too late could impact the overall profitability of the investment.

Success Stories of Investors

Many investors have shared success stories of profiting from investing in crypto during volatile periods. These stories highlight the potential rewards that come with taking calculated risks and staying resilient in the face of market fluctuations.

“I bought Bitcoin during a market dip and held onto it for several years. When the price skyrocketed, I was able to cash out with a substantial profit,” shared a crypto investor who capitalized on market volatility.

- By staying informed about market trends and having a solid investment strategy, investors can navigate market volatility with confidence.

- Some investors have diversified their crypto portfolios during volatile periods, spreading risk across different assets to mitigate potential losses.

Risks Associated with Investing in Crypto During Market Volatility

Investing in cryptocurrency during market volatility comes with its own set of risks that investors need to be aware of. These risks can include sudden price fluctuations, regulatory changes, security breaches, and more. It is important to understand these risks and have strategies in place to mitigate them effectively.

Potential Risks of Investing During Volatile Market Conditions

- Price Volatility: Cryptocurrency prices can change rapidly, leading to significant gains or losses in a short period.

- Regulatory Uncertainty: Government regulations can impact the value of cryptocurrencies and the legality of trading them.

- Security Risks: Cryptocurrency exchanges and wallets can be vulnerable to hacking and theft, putting investors’ funds at risk.

- Liquidity Issues: During times of extreme volatility, it can be difficult to buy or sell cryptocurrencies at desired prices.

Strategies to Mitigate Risks in Crypto Investments During Turbulent Times, Investing in Crypto During Market Volatility

- Diversification: Spread your investments across different cryptocurrencies to reduce the impact of price fluctuations on your portfolio.

- Stay Informed: Keep up to date with the latest news and developments in the cryptocurrency market to make informed investment decisions.

- Use Stop-Loss Orders: Set up stop-loss orders to automatically sell your assets if prices fall below a certain point to limit potential losses.

- Cold Storage: Store your cryptocurrencies offline in cold wallets to protect them from online security threats.

Cautionary Tales of Investors Facing Losses Due to Market Volatility

One infamous example is the Mt. Gox incident in 2014, where a major cryptocurrency exchange filed for bankruptcy after losing hundreds of millions of dollars’ worth of Bitcoin due to a security breach.

Another cautionary tale is the sudden crash of the cryptocurrency market in 2018, wiping out billions of dollars in investor funds within a short period.

Strategies for Investing in Crypto During Market Volatility

In a volatile crypto market, it’s crucial to have a solid investment strategy to navigate the fluctuations and maximize your returns. Here are some tailored strategies to consider:

Diversification and Risk Management

Diversification is key when investing in crypto during market volatility. Spread your investments across different cryptocurrencies to reduce risk. Additionally, consider allocating a portion of your portfolio to more stable assets like fiat currencies or precious metals to hedge against potential losses.

Setting Clear Investment Goals and Timelines

It’s essential to establish clear investment goals and timelines when dealing with market volatility. Determine your risk tolerance, profit targets, and exit strategies before making any investment decisions. Having a well-defined plan will help you stay disciplined and avoid emotional decision-making during turbulent market conditions.

Staying Informed and Adapting to Market Changes

Keep yourself updated on the latest market trends, news, and developments within the crypto industry. Stay vigilant and be prepared to adapt your investment strategy based on changing market conditions. Being proactive and flexible can help you capitalize on opportunities and minimize potential losses in a volatile market environment.