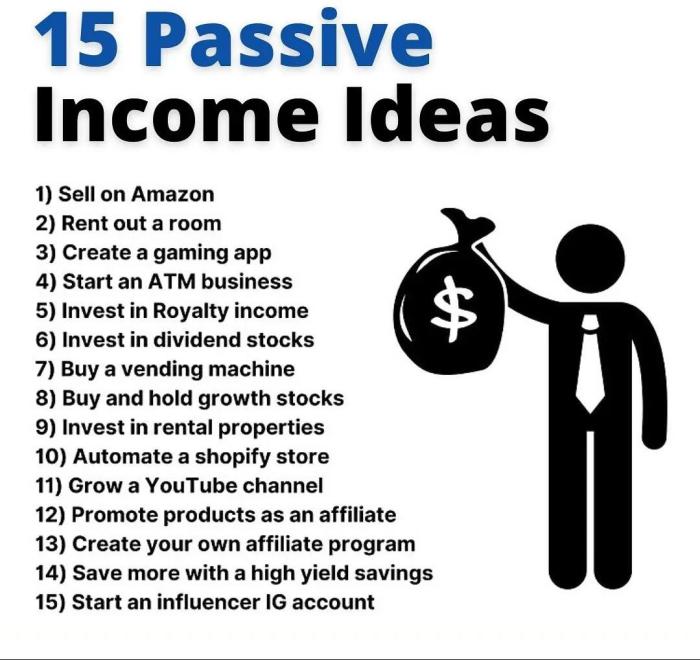

Passive Income Ideas take center stage in the quest for financial independence, offering a glimpse into the realm of lucrative opportunities and smart money moves. From real estate ventures to dividend investing, this journey is about to get exciting.

As we delve deeper into the realm of passive income, we uncover a world of possibilities that can pave the way to a secure financial future.

Introduction to Passive Income Ideas

Passive income refers to earnings that are generated with minimal effort or active involvement. This type of income plays a crucial role in financial planning as it allows individuals to build wealth and achieve financial freedom over time.

Benefits of Generating Passive Income Streams

- 1. Diversification of Income: Passive income streams provide a way to diversify your income sources, reducing reliance on a single source of income.

- 2. Financial Stability: Having multiple passive income streams can help create a more stable financial foundation, especially during economic downturns.

- 3. Time Freedom: Once set up, passive income streams require minimal maintenance, allowing individuals to have more time for other pursuits or activities.

Popular Passive Income Ideas

- 1. Rental Properties: Owning rental properties and collecting monthly rent payments from tenants.

- 2. Dividend Stocks: Investing in dividend-paying stocks to earn regular income from dividends.

- 3. Affiliate Marketing: Promoting other companies’ products and earning a commission for each sale or lead generated.

- 4. Online Courses: Creating and selling online courses on platforms like Udemy or Teachable.

Real Estate as a Passive Income Source

Real estate is a popular and lucrative option for generating passive income. By investing in properties, individuals can earn money without actively working on a day-to-day basis.

Ways to Earn Passive Income Through Real Estate Investments

- Rental Properties: Purchasing residential or commercial properties and renting them out to tenants can provide a steady stream of passive income through monthly rental payments.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to earn passive income through dividends generated by a portfolio of income-producing real estate properties.

- Airbnb Rentals: Renting out properties on platforms like Airbnb can generate passive income through short-term rentals to travelers and visitors.

Successful Real Estate Passive Income Strategies

- Fix-and-Flip: Buying properties at a lower price, renovating them, and selling them at a higher price can result in significant profits.

- Buy and Hold: Acquiring properties with the intention of holding onto them for the long term can lead to appreciation in value and rental income over time.

- Real Estate Crowdfunding: Participating in real estate crowdfunding platforms allows investors to pool their resources to invest in larger real estate projects and earn passive income.

Investing in Stocks for Passive Income

Investing in stocks can be a great way to generate passive income. When you invest in stocks, you are essentially buying a small piece of ownership in a company. As the company grows and profits, the value of your stocks can increase, and some companies also pay out dividends to their shareholders, providing a steady stream of passive income.

Different Investment Strategies for Creating Passive Income through Stocks

- Dividend Investing: Focus on investing in stocks that pay out regular dividends. This can provide a consistent source of passive income.

- Growth Investing: Look for stocks of companies with high growth potential. While these stocks may not provide immediate passive income, their value can increase significantly over time.

- Index Fund Investing: Invest in index funds that track the performance of a specific market index. This can provide diversification and passive income through dividends.

Tip: Diversifying your stock portfolio can help reduce risk and increase potential returns.

Tips for Beginners Looking to Start Investing in Stocks for Passive Income

- Do Your Research: Take the time to learn about different investment strategies and understand the risks involved in stock investing.

- Start Small: Begin with a small investment amount and gradually increase as you gain more experience and confidence in your investment decisions.

- Consider Seeking Professional Help: If you’re unsure about how to start investing in stocks, consider consulting with a financial advisor who can provide guidance tailored to your financial goals.

Online Business and Passive Income

When it comes to generating passive income, online businesses have become a popular choice for many entrepreneurs. The ability to reach a global audience, operate 24/7, and automate processes makes online businesses an attractive option for those looking to earn money passively.

Various Online Business Models for Passive Income

- Affiliate Marketing: By promoting products or services from other companies, you can earn a commission on sales generated through your unique affiliate link.

- Dropshipping: Running an online store without holding inventory, as the products are shipped directly from the supplier to the customer, allowing for a hands-off approach.

- Online Courses: Creating and selling digital courses on platforms like Udemy or Teachable can provide a passive income stream once the course is set up.

Pros and Cons of Building an Online Business for Passive Income

- Pros:

- Flexible Schedule: You can work on your online business at any time that suits you, making it ideal for those looking for freedom and autonomy.

- Scalability: Online businesses have the potential to scale rapidly with the right strategies in place, allowing for exponential growth.

- Cons:

- Initial Investment: Setting up an online business may require upfront costs for website development, marketing, and other essentials.

- Competition: The online space is highly competitive, requiring continuous effort to stand out and attract customers.

Dividend Investing for Passive Income

Dividend investing is a strategy where investors buy shares of companies that pay out dividends to their shareholders. These dividends are typically paid out regularly, providing investors with a steady stream of passive income.

Top Dividend-Paying Stocks for Passive Income

Investing in dividend-paying stocks can be a reliable way to generate passive income. Here are some top dividend-paying stocks that investors may consider:

- 1. Johnson & Johnson (JNJ)

-A well-established company with a history of consistent dividend payouts. - 2. Procter & Gamble (PG)

-Known for its consumer goods and reliable dividends. - 3. AT&T (T)

-A telecommunications giant offering attractive dividend yields. - 4. Apple (AAPL)

-A tech company that has started paying dividends in recent years. - 5. Exxon Mobil (XOM)

-An energy company with a long history of dividend payments.

Strategies for Maximizing Passive Income through Dividend Investing

Maximizing passive income through dividend investing requires a strategic approach. Here are some strategies to consider:

- Reinvest Dividends: Utilize dividend reinvestment plans (DRIPs) to reinvest dividends and compound your returns over time.

- Diversify Your Portfolio: Spread your investments across different sectors and industries to reduce risk and maximize potential returns.

- Focus on Dividend Growth: Look for companies that have a history of increasing their dividend payouts, as this can lead to higher passive income in the future.

- Monitor Dividend Yields: Pay attention to dividend yields and make informed decisions based on the yield and sustainability of dividends.

Passive Income through Affiliate Marketing: Passive Income Ideas

Affiliate marketing is a popular way to generate passive income by promoting products or services from other companies. As an affiliate, you earn a commission for every sale or lead that is generated through your unique affiliate link. This means you can earn money while you sleep, as the sales process is handled by the company you are affiliated with.

How Affiliate Marketing Works, Passive Income Ideas

- Sign up for an affiliate program: Join an affiliate program of a company that aligns with your niche or interests.

- Promote products/services: Create content promoting the products/services using your unique affiliate link.

- Drive traffic: Generate traffic to your content through various marketing channels like social media, email marketing, or .

- Earn commissions: Get paid a commission for every sale or lead that comes through your affiliate link.

Tips for Setting up a Successful Affiliate Marketing Strategy

- Choose the right niche: Select a niche that you are passionate about and has a high demand for products/services.

- Build trust with your audience: Provide valuable content and build credibility to gain the trust of your audience.

- Diversify your affiliate partners: Work with multiple affiliate programs to maximize your earning potential.

- Track your performance: Monitor your affiliate marketing efforts to optimize your strategy and maximize your earnings.

Examples of Affiliate Marketing Success Stories

- Pat Flynn: Pat Flynn is a well-known affiliate marketer who generates passive income through his blog and podcast by promoting various products and services.

- Michelle Schroeder-Gardner: Michelle is another successful affiliate marketer who makes over six figures a month through her blog, Making Sense of Cents.

- Rachel Pedersen: Rachel Pedersen, known as the Queen of Social Media, has built a successful affiliate marketing business by promoting social media tools and courses.