Real Estate Investment Tips: Are you ready to dive into the world of real estate investments and learn how to maximize your returns while minimizing risks? Let’s explore some valuable insights and strategies that can help you succeed in this dynamic market.

Importance of Real Estate Investment

Real estate investment is a valuable asset for several reasons. One key benefit is its potential to generate passive income, allowing investors to earn money without actively working for it. Additionally, real estate investments can provide a hedge against inflation and market volatility, as property values tend to appreciate over time.

Passive Income Generation

Investing in real estate can offer a steady stream of passive income through rental properties. By renting out a property, investors can earn regular rental income that can cover mortgage payments, property maintenance costs, and provide a profit. This passive income can be a reliable source of cash flow, especially during retirement or periods of economic uncertainty.

Portfolio Diversification

Diversifying a portfolio with real estate investments can help spread risk and reduce overall portfolio volatility. Real estate typically has a low correlation with stocks and bonds, meaning that it can provide a buffer against market fluctuations. By including real estate in a diversified investment portfolio, investors can potentially enhance returns and reduce overall risk exposure.

Types of Real Estate Investments

Investing in real estate offers a variety of options for individuals looking to diversify their portfolios. Here are some of the main types of real estate investments to consider:

Residential Real Estate

Residential real estate involves properties used for living purposes, such as single-family homes, condos, townhouses, and apartments. Investing in residential real estate can provide a steady income stream through rental payments and potential appreciation in property value over time.

Commercial Real Estate

Commercial real estate includes properties used for business purposes, such as office buildings, retail spaces, and warehouses. Investing in commercial real estate can offer higher rental yields compared to residential properties, but also comes with higher risks due to economic fluctuations and tenant turnover.

Industrial Real Estate

Industrial real estate involves properties used for manufacturing, distribution, and storage purposes, such as warehouses, factories, and industrial parks. Investing in industrial real estate can be lucrative due to long-term leases and stable cash flow, but it requires a significant capital investment upfront.

Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors. Investing in REITs provides investors with the opportunity to earn dividends from real estate without directly owning physical properties, offering a more liquid and diversified investment option.

Real Estate Crowdfunding

Real estate crowdfunding platforms allow individual investors to pool their resources together to invest in real estate projects, such as residential developments or commercial properties. This type of investment offers a lower barrier to entry and the opportunity to diversify across different properties and locations.Each type of real estate investment comes with its own set of risks and rewards, so it’s essential to carefully evaluate your investment goals and risk tolerance before deciding which option is right for you.

Factors to Consider Before Investing

When diving into the world of real estate investment, there are several crucial factors to consider before making a decision. From the location of the property to the current market trends and the condition of the property, each aspect plays a significant role in determining the success of your investment. Conducting thorough research and setting clear investment goals and timelines are essential steps to take before taking the plunge.

Location

One of the most critical factors to consider before investing in real estate is the location of the property. A prime location can significantly impact the value and potential return on investment. Factors to consider include proximity to amenities, schools, transportation, and overall safety of the neighborhood.

Market Trends

Understanding the current market trends in the real estate industry is key to making informed investment decisions. Keep an eye on factors such as supply and demand, interest rates, and economic indicators that can affect property values and rental income.

Property Condition

The condition of the property you are considering investing in is another crucial factor to evaluate. Conduct a thorough inspection to assess any potential repairs or renovations needed. A well-maintained property can attract higher rental income and increase the overall value of your investment.

Research and Goal Setting

Before making any investment decisions, it is important to conduct extensive research on the property, market, and potential risks involved. Setting clear investment goals and timelines will help guide your decisions and keep you on track towards achieving your desired outcomes.

Financing Real Estate Investments: Real Estate Investment Tips

When it comes to financing real estate investments, there are several options available to investors. Securing the right financing with favorable terms is crucial for the success of your investment. Understanding the concept of leverage and its risks is also essential in real estate investing.

Mortgages

- One of the most common ways to finance real estate investments is through mortgages.

- These loans are secured by the property you’re purchasing and typically have lower interest rates compared to other types of loans.

- It’s important to have a good credit score and a stable income to qualify for a mortgage.

Hard Money Loans

- Hard money loans are short-term, high-interest loans that are typically used by real estate investors who need quick financing.

- These loans are asset-based, meaning they are secured by the property itself rather than the borrower’s credit history.

- Hard money loans are a good option for investors who need to secure a property quickly or who may not qualify for traditional financing.

Tips for Securing Financing

- Shop around and compare different lenders to get the best interest rates and terms.

- Improve your credit score and financial stability to increase your chances of qualifying for favorable financing.

- Consider working with a mortgage broker who can help you find the best loan options for your investment goals.

Leverage in Real Estate Investing

- Leverage in real estate investing refers to using borrowed capital to increase the potential return on an investment.

- By leveraging financing, investors can control a larger asset with a smaller amount of their own money.

- However, leverage also increases risk as any losses will be magnified with borrowed money.

- It’s important for investors to carefully consider the risks and rewards of leveraging their investments.

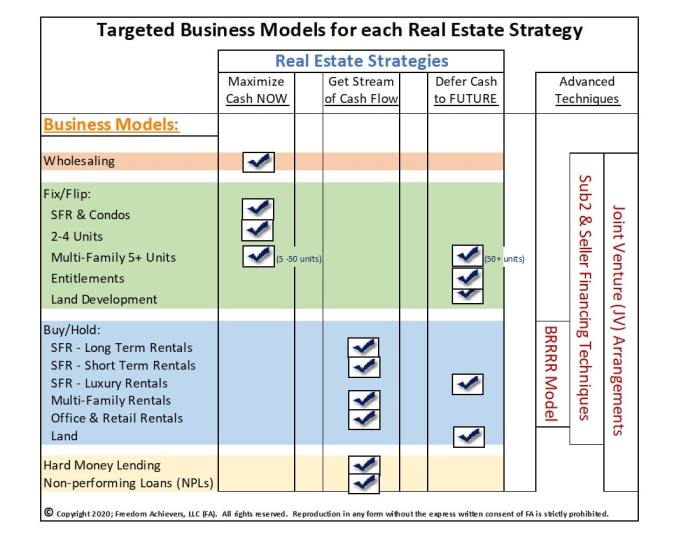

Real Estate Investment Strategies

Investing in real estate offers various strategies for investors to consider based on their goals, risk tolerance, and market conditions. Here are some common real estate investment strategies to help you develop a successful approach to investing in properties:

Buy and Hold Strategy

- This strategy involves purchasing a property with the intention of holding onto it for the long term.

- Investors aim to generate passive income through rental payments and benefit from property appreciation over time.

- It is important to carefully select properties in high-demand areas with potential for growth to maximize returns.

Fix and Flip Strategy, Real Estate Investment Tips

- With this strategy, investors buy properties that need renovation or repairs at a lower price, improve them, and then sell for a profit.

- Successful execution requires a keen eye for potential value-add opportunities and efficient project management skills.

- Market research and understanding renovation costs are crucial for making informed decisions and maximizing profits.

Rental Properties Strategy

- Investors purchase properties to rent out to tenants and generate continuous rental income.

- Choosing the right location, setting competitive rental rates, and maintaining properties are key factors for success in this strategy.

- Long-term viability and scalability of rental properties depend on effective property management and tenant relations.

Adapting Strategies to Market Conditions

- Market conditions, such as interest rates, housing demand, and economic factors, can impact the success of real estate investment strategies.

- Investors should stay informed about market trends and adjust their strategies accordingly to mitigate risks and capitalize on opportunities.

- Diversifying investments across different strategies and property types can help minimize exposure to market fluctuations and enhance overall portfolio performance.

Managing Real Estate Investments

When it comes to real estate investments, managing your properties effectively is key to success. Proper property management helps in maintaining and increasing the value of your investments, ensuring a steady income flow, and minimizing risks.

Importance of Property Management

Effective property management is crucial for ensuring that your real estate investments remain profitable and well-maintained over time. It involves tasks such as finding and screening tenants, collecting rent, handling maintenance and repairs, and ensuring compliance with laws and regulations.

- Regular property inspections to identify and address any issues promptly.

- Effective communication with tenants to build positive relationships and address concerns in a timely manner.

- Proper financial management to ensure expenses are controlled and income is maximized.

- Adherence to legal requirements and regulations to avoid potential legal issues.

Finding Reliable Property Managers

If you decide to hire a property manager instead of managing your properties independently, it’s essential to find a reliable and trustworthy professional. Consider factors such as experience, reputation, communication skills, and fees when selecting a property manager.

- Ask for referrals from other real estate investors or professionals in the industry.

- Interview multiple property managers to compare services and fees.

- Check online reviews and ratings to gauge the reputation of potential property managers.

- Ensure the property manager has a clear understanding of local market trends and regulations.

Maximizing Returns through Effective Management

To maximize returns and minimize risks in your real estate investments, implementing effective property management strategies is essential. By focusing on tenant satisfaction, efficient maintenance, and financial planning, you can ensure the long-term success of your investments.

- Offer competitive rental rates to attract and retain quality tenants.

- Invest in regular maintenance and upgrades to increase property value and tenant satisfaction.

- Create a detailed budget and financial plan to track expenses and optimize income.

- Stay informed about market trends and adjust your strategies accordingly to capitalize on opportunities.