Security and Risks of Crypto Investments delve into the crucial aspects of protecting your investments in the digital realm, exploring the various threats and measures to secure your crypto holdings.

From understanding security concepts to navigating potential risks, this topic sheds light on the dynamic landscape of crypto investments.

Overview of Crypto Investments Security

When it comes to investing in cryptocurrencies, security is a crucial aspect that cannot be overlooked. In this digital landscape, where transactions are conducted online and assets are stored in digital wallets, ensuring the safety of your investments is paramount.

Concept of Security in Crypto Investments, Security and Risks of Crypto Investments

Security in crypto investments refers to the measures taken to protect your digital assets from unauthorized access, theft, and other malicious activities. This includes safeguarding your private keys, using secure wallets, and implementing strong authentication methods.

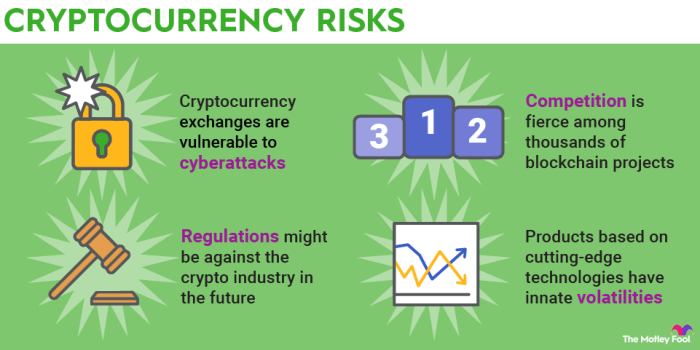

Common Risks Associated with Investing in Cryptocurrencies

- Volatility: Cryptocurrency prices can be highly volatile, leading to sudden and significant fluctuations in value.

- Hacking and Cyberattacks: Cryptocurrency exchanges and wallets are prime targets for hackers, putting your investments at risk of theft.

- Regulatory Uncertainty: The lack of clear regulations in the crypto space can expose investors to legal risks and uncertainties.

- Scams and Frauds: The decentralized nature of cryptocurrencies makes it easier for scammers to operate, posing a threat to unsuspecting investors.

Importance of Security Measures in the Crypto Investment Space

Implementing robust security measures is essential to safeguarding your crypto investments and protecting them from potential threats. By using secure wallets, following best practices for storing private keys, and staying informed about the latest security trends, investors can mitigate risks and ensure the safety of their assets.

Types of Security Risks in Crypto Investments: Security And Risks Of Crypto Investments

When it comes to investing in cryptocurrencies, there are several security risks that investors need to be aware of in order to protect their assets and investments. These risks can range from hacking and phishing attacks to outright scams that can result in significant financial loss.

Hacking

One of the most common security risks in the crypto industry is hacking. Hackers often target cryptocurrency exchanges and wallets in order to steal funds from unsuspecting investors. One high-profile example of a hacking incident is the Mt. Gox exchange hack in 2014, where millions of dollars worth of Bitcoin were stolen.

Phishing

Phishing attacks are another common security risk in the world of crypto investments. Scammers often create fake websites and emails that mimic legitimate cryptocurrency platforms in order to trick users into giving away their login credentials or private keys. These attacks can result in the loss of funds and sensitive information.

Scams

Crypto scams come in many forms, including Ponzi schemes, fake ICOs, and fraudulent investment schemes. Investors need to be cautious when approached with promises of guaranteed returns or quick profits, as these are often red flags for potential scams. One infamous example is the Bitconnect Ponzi scheme, which collapsed in 2018, resulting in massive losses for investors.

Regulatory Issues

Regulatory uncertainty and issues can also pose a significant security risk for crypto investments. Changes in regulations or government crackdowns on cryptocurrency exchanges can impact the value and security of investments. For example, the SEC’s actions against certain ICOs have caused volatility in the market and raised concerns about investor protection.

Security Measures for Mitigating Risks

Cryptocurrency investments come with their fair share of risks, but there are security measures that can be implemented to mitigate these risks and protect your assets.

Role of Cold Storage, Hardware Wallets, and Multi-Factor Authentication

Utilizing cold storage, hardware wallets, and multi-factor authentication are essential practices in enhancing the security of your cryptocurrency investments. Cold storage refers to keeping your digital assets offline, away from potential online threats. Hardware wallets, such as Ledger or Trezor, provide an extra layer of security by storing your private keys offline. Multi-factor authentication adds an additional step to the login process, making it harder for unauthorized users to gain access to your accounts.

Centralized vs. Decentralized Exchanges

When it comes to security features, centralized exchanges are typically seen as less secure than decentralized exchanges. Centralized exchanges are susceptible to hacks and security breaches due to their centralized nature, where a single point of failure can compromise the entire platform. On the other hand, decentralized exchanges operate on a peer-to-peer network, reducing the risk of a single point of failure. Additionally, decentralized exchanges do not hold users’ funds, further enhancing security and reducing the risk of hacking attacks.

Impact of Security Breaches on Crypto Investors

When security breaches occur in the world of cryptocurrencies, the effects can be far-reaching and significant. Not only do these breaches compromise the security and integrity of the digital assets, but they also have a direct impact on the investors involved.

Value of Cryptocurrencies

- Security breaches can lead to a decrease in the value of cryptocurrencies. When investors lose confidence in the security of a particular coin or exchange, they may choose to sell off their holdings, causing the price to drop.

- These incidents can also tarnish the reputation of the affected cryptocurrency, making it less appealing to potential investors and leading to a decrease in demand.

Psychological Impact on Investors

- Security breaches can shake investors’ confidence and trust in the cryptocurrency market as a whole. The fear of losing their investments or personal information can cause panic and uncertainty among investors.

- Investors may become more cautious and hesitant to make new investments, leading to a decrease in trading volume and overall market activity.

Market Trends

- Examples like the Mt. Gox exchange hack in 2014, where millions of dollars worth of Bitcoin were stolen, led to a sharp decline in the price of Bitcoin and negatively impacted investor sentiment.

- The 2016 Bitfinex hack, which resulted in the loss of over $60 million worth of cryptocurrency, caused a temporary drop in the market value of Bitcoin and other digital assets.