With The Impact of Crypto on Traditional Asset Classes at the forefront, get ready to dive into a world where digital currencies shake up the traditional investment landscape. Buckle up for a wild ride through the realms of finance and innovation!

Traditional asset classes like stocks and real estate may have met their match with the rise of cryptocurrencies. Brace yourself for a narrative that explores the collision of old-school investments and cutting-edge digital currencies.

Overview of Traditional Asset Classes

Traditional asset classes are categories of investments that have been commonly used by investors to build wealth over time. These asset classes typically include stocks, bonds, real estate, and commodities.

Stocks

Stocks represent ownership in a company and are considered one of the riskier traditional asset classes. Investors buy shares of a company’s stock in the hope that the value will increase over time.

Bonds

Bonds are debt securities issued by governments or corporations. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments.

Real Estate

Real estate includes properties such as residential homes, commercial buildings, and land. Real estate investments can provide rental income and potential appreciation in property value.

Commodities

Commodities are raw materials or primary agricultural products that can be bought and sold, such as gold, oil, and wheat. Investors often use commodities to diversify their portfolios and hedge against inflation.

Introduction to Cryptocurrency: The Impact Of Crypto On Traditional Asset Classes

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central authority, making it decentralized and immune to government interference or manipulation. The significance of cryptocurrency in the financial market lies in its potential to revolutionize the way transactions are conducted, offering a secure, transparent, and efficient alternative to traditional banking systems.

Key Features of Cryptocurrency

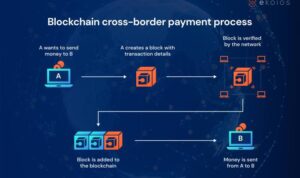

- Decentralization: Cryptocurrency operates on a decentralized network of computers, known as blockchain technology, which allows for peer-to-peer transactions without the need for intermediaries like banks.

- Security: Transactions made with cryptocurrency are encrypted and secure, reducing the risk of fraud and identity theft.

- Transparency: The blockchain ledger records all transactions publicly, ensuring accountability and preventing double-spending.

Popular Cryptocurrencies

- Bitcoin: Considered the first and most well-known cryptocurrency, Bitcoin was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

- Ethereum: Launched in 2015, Ethereum is a decentralized platform that enables smart contracts and decentralized applications (DApps) to be built and operated without any downtime, fraud, control, or interference from a third party.

- Litecoin: Created by Charlie Lee in 2011, Litecoin is often referred to as the silver to Bitcoin’s gold. It is designed to produce blocks more frequently and has a faster transaction confirmation time.

The Impact of Cryptocurrency on Traditional Asset Classes

Cryptocurrency has significantly impacted traditional asset classes in various ways, influencing investment strategies, portfolio diversification, and overall market dynamics.

Investment Strategies

Cryptocurrency’s emergence as a new asset class has provided investors with alternative investment opportunities beyond traditional stocks, bonds, and real estate. The high volatility and potential for high returns in the crypto market have led to the adoption of new investment strategies, such as day trading, swing trading, and long-term holding. Investors now have the option to diversify their portfolios with cryptocurrencies to potentially enhance returns and mitigate risks.

Correlation with Traditional Asset Classes

The correlation between cryptocurrency and traditional asset classes has been a topic of debate among investors and analysts. While some believe that cryptocurrencies offer diversification benefits due to their low correlation with stocks and bonds, others argue that the high volatility of cryptocurrencies can negatively impact traditional asset classes during market downturns. Despite this, many investors see cryptocurrencies as a hedge against inflation and economic uncertainty, leading to increased interest in incorporating digital assets into traditional portfolios.

Volatility Impact

The volatility of cryptocurrency has had a significant impact on traditional asset classes, especially during periods of extreme price fluctuations. The rapid price movements in the crypto market can spill over into traditional markets, causing ripple effects on stocks, bonds, and commodities. Investors need to carefully consider the potential risks and rewards of including cryptocurrencies in their portfolios, as the volatile nature of digital assets can amplify overall portfolio volatility and risk.

Comparison of Returns

Cryptocurrency has gained significant attention in recent years due to its high volatility and potential for substantial returns. When comparing the historical returns of cryptocurrency with traditional asset classes such as stocks, bonds, and real estate, it is important to consider the risk-adjusted returns of each investment.

Historical Returns, The Impact of Crypto on Traditional Asset Classes

Cryptocurrency, like Bitcoin and Ethereum, has shown incredible returns over the past decade, with some digital assets experiencing exponential growth in value. In contrast, traditional asset classes have provided more stable but lower returns over the same period.

Risk-Adjusted Returns

Investing in cryptocurrency comes with higher risks compared to traditional assets. The extreme price fluctuations and lack of regulation in the crypto market can lead to significant losses. Therefore, when analyzing risk-adjusted returns, it is crucial to consider the volatility and unpredictability of the cryptocurrency market.

Potential for Higher Returns

Including cryptocurrency in a diversified portfolio can potentially lead to higher returns, but it also increases the risk of substantial losses. The high volatility of cryptocurrencies can amplify gains, but it can also result in significant drawdowns. Investors must carefully weigh the potential for higher returns against the increased risk when deciding to allocate funds to cryptocurrency assets.