What is Tokenization and How Does it Benefit Crypto kicks off this discussion with a fresh and engaging look at the world of cryptocurrency, breaking down complex concepts into easy-to-understand bites for the hip high school crowd.

Get ready to dive into the fascinating realm of tokenization and its impact on the crypto market, as we unravel the mysteries behind this innovative technology.

What is Tokenization?

Tokenization in the context of cryptocurrency refers to the process of converting real-world assets into digital tokens on a blockchain. These tokens represent ownership or a share of the underlying asset and can be traded or exchanged like any other cryptocurrency.

Tokenization works by issuing digital tokens that are backed by a physical asset, such as real estate, art, or stocks. These tokens are created and stored on a blockchain, providing transparency, security, and immutability to the ownership of the asset.

Examples of Tokenized Assets

- Real Estate: Fractional ownership of properties can be tokenized, allowing investors to own a portion of a property without the need for large capital investments.

- Art: Tokenizing artwork enables art collectors to buy and sell shares of valuable pieces, making art investment more accessible to a wider audience.

- Stocks: Companies can tokenize their stocks, making it easier for investors to buy and trade shares without traditional intermediaries.

Benefits of Tokenization in Crypto

Tokenization in the world of cryptocurrency brings several key benefits that revolutionize the traditional investment landscape.

Enhanced Liquidity in Illiquid Assets

Tokenization allows assets that are typically illiquid, such as real estate or fine art, to be divided into digital tokens. These tokens can then be easily traded on blockchain platforms, increasing liquidity and enabling more investors to participate in these markets.

Fractional Ownership

Through tokenization, investors can purchase fractions of high-value assets, enabling even those with limited capital to own a piece of valuable property. This concept of fractional ownership democratizes investment opportunities and opens up new avenues for diversification.

Reduced Barriers to Entry

Tokenization eliminates many of the traditional barriers to entry for investors, such as high minimum investment requirements or geographical restrictions. By digitizing assets and making them more accessible, tokenization levels the playing field and allows a wider range of individuals to participate in investment opportunities.

Increased Accessibility and Transparency: What Is Tokenization And How Does It Benefit Crypto

Tokenization plays a crucial role in increasing accessibility and transparency in the world of crypto investments. Let’s dive into how this works.

Opening Up Investment Opportunities

Tokenization allows assets to be divided into smaller, more affordable units, known as tokens. This fractional ownership model makes it easier for a wider audience to invest in assets that were previously out of reach due to high costs. For example, through tokenization, an individual can invest in real estate or artwork with just a fraction of the total value, opening up new investment opportunities to a larger pool of investors.

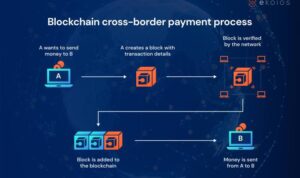

Blockchain Technology for Transparency

Blockchain technology ensures transparency in tokenized assets by providing a decentralized and immutable ledger of transactions. Every transaction made with tokens is recorded on the blockchain, making it visible to all participants. This transparency builds trust among investors as they can verify the ownership, history, and authenticity of tokenized assets in real-time. Additionally, the use of blockchain technology eliminates the need for intermediaries, reducing the risk of fraud and manipulation in the investment process.

Smart Contracts in Tokenization, What is Tokenization and How Does it Benefit Crypto

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, play a crucial role in facilitating tokenization processes. These contracts automate the transfer of tokens between parties once predefined conditions are met, eliminating the need for manual intervention. Smart contracts ensure that transactions are secure, transparent, and irreversible, increasing efficiency and reducing the risk of human error. By leveraging smart contracts, tokenization becomes a seamless and trustless process, benefiting both issuers and investors alike.

Security and Immutability

Tokenization on the blockchain provides robust security features that enhance the overall safety of digital assets. By leveraging cryptographic algorithms and decentralized networks, tokenization ensures that transactions are secure, transparent, and resistant to tampering or fraud.

Enhanced Asset Ownership Verification

Tokenization greatly improves the process of verifying asset ownership by providing a transparent and immutable record of transactions. Each token represents a unique digital asset, and ownership is easily verified through the blockchain, which maintains a secure and tamper-proof ledger of all transactions.

- Blockchain technology ensures that asset ownership is easily traceable and verifiable, reducing the risk of fraudulent activities.

- Smart contracts embedded in tokenized assets automate ownership verification processes, streamlining transactions and minimizing human error.

- Tokenization allows for fractional ownership of assets, enabling broader access to investment opportunities while maintaining ownership transparency.

Immutable Records in Tokenized Assets

The concept of immutability in tokenized assets refers to the permanent and unchangeable nature of transaction records stored on the blockchain. Once a transaction is recorded on the blockchain, it cannot be altered or deleted, ensuring a secure and transparent record of asset ownership.

Immutable records provide a high level of security and trust in tokenized assets, as all transactions are permanently stored on the blockchain, making it virtually impossible to manipulate or falsify ownership details.

- Immutability in tokenized assets eliminates the need for intermediaries or centralized authorities to validate transactions, reducing costs and enhancing security.

- By maintaining an immutable record of ownership, tokenization enhances transparency and accountability in asset transactions, fostering trust among participants.

- The permanent nature of blockchain records ensures that asset ownership remains secure and verifiable, even in complex multi-party transactions.